How to Use Technical Analysis for Crypto Trading Success in the US

Technical analysis in crypto trading involves using historical price charts and indicators to forecast future price movements, helping US traders make informed decisions and improve their trading strategies.

Ready to elevate your crypto trading game in the US market? Understanding and implementing how to use technical analysis to improve your crypto trading in the US market could be the key to unlocking more informed and profitable decisions.

Understanding Technical Analysis in Crypto Trading

Technical analysis (TA) is a methodology used by traders to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. In the context of how to use technical analysis to improve your crypto trading in the US market, it’s about understanding these tools and applying them effectively to the unique characteristics of the crypto market.

Unlike fundamental analysis, which considers factors like financial statements and industry trends, technical analysis is primarily concerned with price charts and various indicators derived from historical data. For crypto traders in the US, this means analyzing patterns, trends, and signals to make informed decisions.

Key Concepts of Technical Analysis

Several key concepts underpin technical analysis. These concepts help traders interpret market movements and make informed decisions.

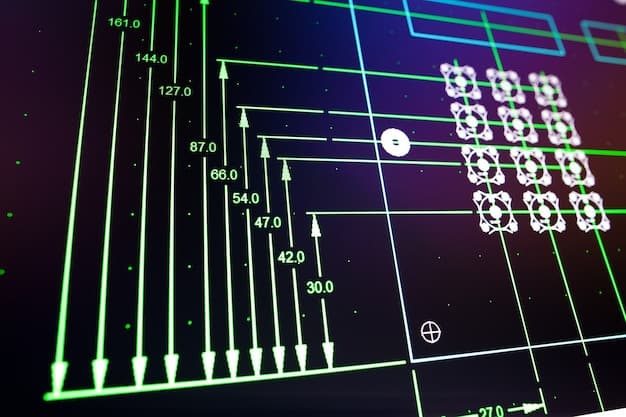

- Price Action: The movement of prices over time, typically visualized using charts.

- Support and Resistance Levels: Price levels where the price tends to find support (bounce up) or resistance (struggle to break through).

- Trends: The general direction of the price movement (uptrend, downtrend, or sideways).

- Volume: The number of units of a cryptocurrency traded in a given period, which can confirm the strength of a trend.

Mastering these core concepts is essential for anyone aiming to improve their crypto trading through technical analysis. By recognizing patterns and understanding how prices behave, traders can better anticipate future movements.

Essential Technical Indicators for Crypto Traders

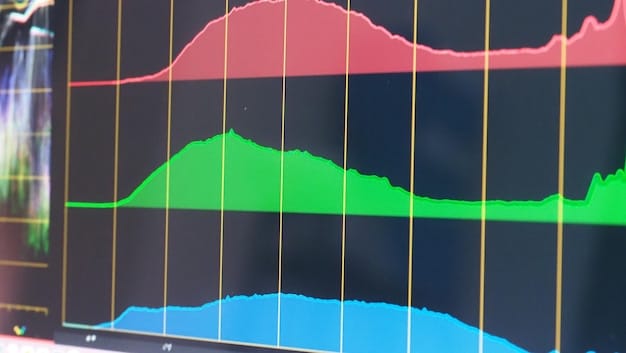

Technical indicators are calculations based on price and volume data, used to forecast future price movements. Understanding and using these indicators are crucial in how to use technical analysis to improve your crypto trading in the US market.

Several indicators are particularly popular among crypto traders. Each indicator offers unique insights into market behavior, helping traders make informed decisions about when to buy or sell.

Popular Technical Indicators

- Moving Averages (MA): Smooth out price data to identify trends, with common periods including 50, 100, and 200 days.

- Relative Strength Index (RSI): Measures the speed and change of price movements, oscillating between 0 and 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

- Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Fibonacci Retracement: Identifies potential support and resistance levels based on Fibonacci ratios.

- Bollinger Bands: Measures the volatility of an asset, providing a range within which the price is expected to fluctuate.

Choosing the right combination of indicators and understanding how to interpret them is vital for successful crypto trading. As crypto markets can be highly volatile, indicators must be carefully chosen and applied based on one’s risk tolerance and trading strategy.

Chart Patterns: Identifying Trading Opportunities

Chart patterns are specific formations on price charts that suggest potential future price movements. Recognizing these patterns is an integral part of how to use technical analysis to improve your crypto trading in the US market.

Different chart patterns can signal bullish (uptrend) or bearish (downtrend) opportunities. Traders watch for these patterns to confirm potential entry and exit points.

Common Bullish and Bearish Patterns

There are several common chart patterns that crypto traders use to identify trends and make trading decisions.

- Head and Shoulders: A bearish reversal pattern that signals the potential end of an uptrend.

- Inverse Head and Shoulders: A bullish reversal pattern indicating the potential end of a downtrend.

- Double Top/Bottom: Reversal patterns that indicate the price is likely to reverse after reaching a high or low point twice.

- Triangles (Ascending, Descending, Symmetrical): Patterns that indicate a period of consolidation followed by a breakout in either direction.

Becoming proficient at recognizing these patterns can significantly improve trading accuracy. However, it’s essential to confirm chart patterns with other indicators and price action to reduce false signals.

Risk Management Strategies in Crypto TA

Risk management is crucial when applying technical analysis in crypto trading. Without proper risk management, even the most accurate technical analysis can lead to significant losses. Understanding risk management is as important as learning how to use technical analysis to improve your crypto trading in the US market.

Effective risk management involves setting stop-loss orders, managing position sizes, and diversifying your crypto portfolio.

Key Risk Management Techniques

Below are some risk management strategies that can protect investments and minimize the risk of large losses.

- Stop-Loss Orders: Automated orders to sell a cryptocurrency if its price falls to a specified level.

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade based on your risk tolerance.

- Diversification: Spreading your investments across multiple cryptocurrencies to reduce the impact of any single asset’s performance.

By incorporating these strategies, traders can protect their capital and ensure long-term success. Careful risk assessment and disciplined execution are vital components of successful crypto trading.

Combining Technical Analysis with Fundamental Analysis

While technical analysis focuses on price charts and indicators, combining it with fundamental analysis can provide a more comprehensive view of the market. This integration is key to truly understanding how to use technical analysis to improve your crypto trading in the US market.

Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency by examining factors such as its technology, use cases, team, and market adoption. Combining this with the insights from technical analysis can lead to better-informed trading decisions.

Benefits of Combining TA and FA

- Comprehensive Market View: Combining both approaches allows for a more nuanced understanding of market dynamics.

- Better Entry/Exit Points: Aligning technical signals with positive fundamental developments can confirm trading decisions.

- Reduced Risk: Fundamental analysis can help identify cryptocurrencies with solid long-term potential, while technical analysis provides optimal timing for entry and exit.

Traders who use both technical and fundamental analysis strategies gain a significant advantage. This holistic approach enhances decision-making and improves overall trading performance.

Advanced Technical Analysis Techniques

For experienced crypto traders, mastering advanced technical analysis techniques can provide additional insights and improve trading accuracy. These advanced techniques go beyond basic indicators and chart patterns, offering a more sophisticated approach to how to use technical analysis to improve your crypto trading in the US market.

Some of these advanced techniques include Elliott Wave Theory, Ichimoku Cloud, and harmonic patterns.

Exploring Advanced Techniques

Here are some advanced technical analysis strategies that experienced traders can use to fine-tune their trading.

- Elliott Wave Theory: Identifies recurring patterns in market prices, based on the belief that markets move in specific wave patterns.

- Ichimoku Cloud: A versatile indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals.

- Harmonic Patterns: Geometric price patterns that use Fibonacci ratios to predict potential reversal points. These include patterns like Gartley, Butterfly, and Crab.

Using advanced methodologies can provide a competitive edge in the crypto market and can help to maximize gains.

Staying Updated and Continuous Learning

The crypto market is constantly evolving, with new technologies, trends, and trading strategies emerging regularly. Therefore, staying updated and continuously learning is crucial in order to effectively apply how to use technical analysis to improve your crypto trading in the US market.

Traders should regularly follow industry news, participate in trading communities, and seek out educational resources to enhance their skills and knowledge.

Resources for Continuous Learning

Many resources and platforms can help enhance your knowledge in technical analysis:

- Online Courses: Platforms like Coursera and Udemy offer courses on trading and technical analysis.

- Trading Communities: Engage in forums like Reddit (r/CryptoTrading) to exchange ideas and strategies with other traders.

- Trading Books: Books like “Technical Analysis of Stock Trends” by Edwards and Magee provide in-depth knowledge of TA principles.

By staying informed, adaptable, and committed to continuous learning, traders can stay ahead of the curve and consistently improve their trading performance.

| Key Point | Brief Description |

|---|---|

| 📊 Understanding TA | Learn basics like price action, support, and resistance. |

| 📈 Essential Indicators | Use Moving Averages, RSI, MACD for analysis. |

| 🛡️ Risk Management | Implement stop-loss orders and manage position sizes. |

| 📚 Continuous Learning | Stay updated through courses, communities, and books. |

Frequently Asked Questions

▼

Technical analysis involves evaluating past market data, primarily price and volume, to forecast future price movements. Traders use charts and indicators to identify patterns and trends.

▼

Popular indicators include Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). These can provide insights into trend direction and potential reversals.

▼

Risk management is crucial due to the high volatility of crypto markets. Techniques like stop-loss orders and appropriate position sizing can protect capital and mitigate potential losses.

▼

No, technical analysis does not guarantee profits. It provides probabilities and potential scenarios based on historical data. Markets are inherently unpredictable and subject to various influencing factors.

▼

Regularly, at least monthly, to adapt to market changes. Review your strategy to ensure alignment with your goals and tolerance. Continuous learning and flexibility are key.

Conclusion

In conclusion, mastering how to use technical analysis to improve your crypto trading in the US market involves learning key concepts, using essential indicators, recognizing chart patterns, managing risk effectively, and staying updated with continuous learning. By combining these elements, traders can make more informed decisions and enhance their prospects for success in the volatile crypto market.