How to Rebalance Your Crypto Portfolio for 2025 Gains: US Guide

Rebalancing your cryptocurrency portfolio is crucial for maximizing gains in 2025, especially for US investors navigating market volatility; this guide provides actionable strategies for effective portfolio adjustments.

Are you a US investor looking to optimize your crypto portfolio for maximum gains in 2025? The key lies in strategic rebalancing. This guide on how to rebalance your crypto portfolio for maximum gains in 2025: A US investor’s guide, will walk you through the essential steps to navigate the volatile crypto market and position yourself for success.

Understanding Crypto Portfolio Rebalancing

Portfolio rebalancing in the crypto world is about maintaining your desired asset allocation. It’s like a financial tune-up, ensuring your portfolio aligns with your risk tolerance and investment goals.

Why bother rebalancing? The crypto market is notoriously volatile. What starts as a balanced portfolio can quickly become skewed due to the rapid price swings of different cryptocurrencies.

Why Rebalancing Matters in Crypto

Rebalancing helps manage risk and potentially increase returns. It’s not about chasing the hottest coins, but about sticking to a plan.

- Risk Management: Rebalancing prevents overexposure to volatile assets.

- Profit Taking: It allows you to sell high and reinvest in undervalued assets.

- Discipline: It enforces a disciplined approach to investing, preventing emotional decisions.

Rebalancing isn’t a one-time event; it’s an ongoing process. Let’s dive into the how-to.

Setting Your Crypto Investment Goals

Before you start rebalancing, it’s essential to define your investment goals. This will guide your asset allocation and rebalancing strategy.

Are you looking for long-term growth, income, or a combination of both? Your goals will influence the types of cryptocurrencies you hold and how frequently you rebalance.

Define Your Risk Tolerance

Understanding your risk tolerance is crucial. Are you comfortable with high volatility, or do you prefer a more conservative approach?

A high-risk tolerance might allow for a portfolio with a higher percentage of altcoins, while a lower risk tolerance might favor more established cryptocurrencies like Bitcoin and Ethereum.

Once you’ve set your goals and assessed your risk tolerance, you can determine your ideal asset allocation.

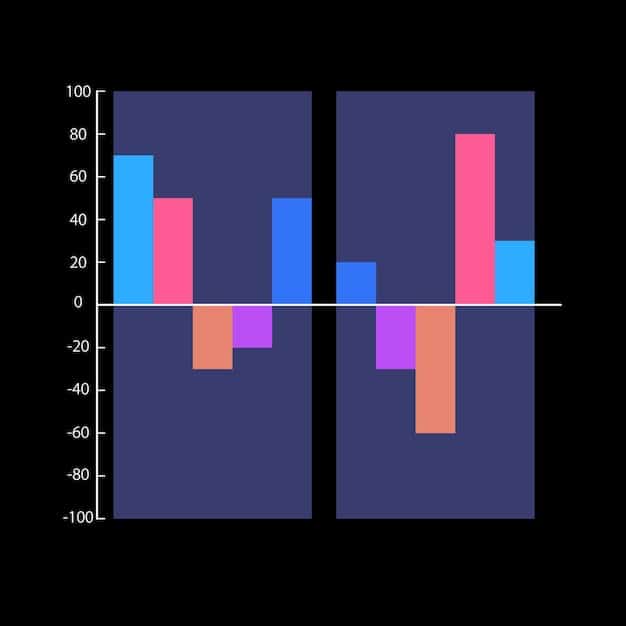

Determining Your Ideal Crypto Asset Allocation

Asset allocation is the process of dividing your investment capital among different asset classes. In the crypto world, this means deciding what percentage of your portfolio to allocate to Bitcoin, Ethereum, altcoins, and stablecoins.

A well-diversified portfolio can help mitigate risk and potentially increase returns. However, diversification doesn’t guarantee profits.

Bitcoin vs. Altcoins

Consider the balance between Bitcoin and altcoins. Bitcoin is generally considered the “safest” cryptocurrency, while altcoins offer higher potential returns but also come with higher risk.

- Bitcoin: The most established cryptocurrency, often seen as a store of value.

- Ethereum: The leading platform for decentralized applications (dApps) and smart contracts.

- Altcoins: Cryptocurrencies other than Bitcoin, ranging from established projects to speculative ventures.

- Stablecoins: Cryptocurrencies pegged to a stable asset like the US dollar, providing stability in volatile markets.

Your asset allocation should reflect your risk tolerance and investment goals. A common strategy is to allocate a larger percentage to Bitcoin and Ethereum, with a smaller percentage allocated to altcoins.

Strategies for Rebalancing Your Crypto Portfolio

Now that you’ve defined your goals, assessed your risk tolerance, and determined your ideal asset allocation, it’s time to develop a rebalancing strategy.

There are several approaches to rebalancing, each with its own advantages and disadvantages. Consider your personal preferences and investment style when choosing a strategy.

Time-Based Rebalancing

Time-based rebalancing involves rebalancing your portfolio at fixed intervals, such as quarterly or annually. This is a simple and straightforward approach.

The advantage of time-based rebalancing is that it’s easy to implement and doesn’t require constant monitoring of the market.

Threshold-Based Rebalancing

Threshold-based rebalancing involves rebalancing your portfolio when the allocation of an asset deviates from your target allocation by a certain percentage. For example, you might rebalance when Bitcoin’s allocation exceeds your target by 5%.

- Set Thresholds: Determine the percentage deviation that triggers a rebalance.

- Monitor Portfolio: Track your asset allocation regularly.

- Rebalance When Triggered: Buy or sell assets to bring your portfolio back into alignment.

Threshold-based rebalancing can be more effective than time-based rebalancing, as it responds directly to market movements.

Tax Implications of Crypto Rebalancing in the US

US investors need to be aware of the tax implications of rebalancing their crypto portfolios. Each time you sell a cryptocurrency, you may incur capital gains taxes.

Understanding the tax implications can help you make informed decisions about when and how to rebalance.

Short-Term vs. Long-Term Capital Gains

The tax rate on capital gains depends on how long you held the cryptocurrency before selling it. Short-term capital gains (held for one year or less) are taxed at your ordinary income tax rate, while long-term capital gains (held for more than one year) are taxed at a lower rate.

Consider consulting with a tax professional to understand the specific tax implications of your crypto rebalancing strategy.

Rebalancing offers great benefits but keep up with US Tax laws, lets get in to tools and platforms you can use.

Tools and Platforms for Crypto Portfolio Rebalancing

Several tools and platforms can help you rebalance your crypto portfolio. These tools can automate the process and provide valuable insights into your portfolio’s performance.

Some popular options include cryptocurrency exchanges with rebalancing features, portfolio tracking apps, and specialized rebalancing services.

- CoinTracking: Platform for tracking and managing crypto portfolios.

- Blockfolio (FTX App): Crypto portfolio tracker with price alerts and news.

- Shakepay: Canadian platform that aims to provide the easiest way to buy Bitcoin.

When choosing a tool or platform, consider factors such as ease of use, fees, security, and features.

Staying Informed: Market Trends in 2025

The crypto market is constantly evolving, so it’s essential to stay informed about the latest trends and developments. This will help you make informed decisions about your rebalancing strategy.

Pay attention to factors such as regulatory changes, technological advancements, and macroeconomic trends.

Key Factors to Watch

Keep an eye on factors that can impact the crypto market, such as inflation, interest rates, and government policies.

By staying informed and adapting your strategy as needed, you can position yourself for success in the ever-changing crypto landscape.

| Key Point | Brief Description |

|---|---|

| 🎯 Define Goals | Establish clear investment goals to guide asset allocation. |

| ⚖️ Risk Tolerance | Understand your risk tolerance to balance Bitcoin, altcoins, & stablecoins. |

| 📅 Rebalancing Strategy | Choose between time-based and threshold-based rebalancing. |

| 💰 Tax Awareness | Be aware of tax implications, especially short-term vs. long-term capital gains. |

FAQ

▼

Crypto portfolio rebalancing involves adjusting your asset allocation to maintain your desired balance. This helps manage risk and ensures your portfolio aligns with your investment goals.

▼

Rebalancing is crucial for US investors to mitigate risk during high market volatility and potentially increase returns by selling overvalued assets and reinvesting in undervalued ones.

▼

The frequency depends on your strategy (time-based or threshold-based). Time-based is quarterly or annually, while threshold-based is triggered by deviations from your target allocation.

▼

Selling cryptocurrencies can trigger capital gains taxes. Short-term gains are taxed at ordinary income rates, while long-term gains are taxed at lower rates. Consult a tax professional.

▼

Tools include cryptocurrency exchanges with rebalancing features, portfolio tracking apps like CoinTracking, and specialized rebalancing services. Consider ease of use, fees, and security.

Conclusion

Rebalancing your crypto portfolio is a proactive strategy for managing risk and maximizing gains in 2025. By setting clear goals, understanding your risk tolerance, and staying informed about market trends, you can effectively navigate the volatile crypto landscape and position yourself for financial success.