Blockchain Carbon Credits: US Climate Change Fight by 2030

Blockchain-based carbon credits offer a transparent and efficient mechanism to combat climate change in the US by 2030, leveraging blockchain technology to ensure the integrity and traceability of carbon offset projects.

Can blockchain-based carbon credits: how blockchain can help combat climate change in the US by 2030? As the US grapples with the urgency of climate change, innovative solutions are needed to meet ambitious emissions reduction targets. Blockchain technology offers a promising avenue for enhancing the integrity, transparency, and efficiency of carbon markets.

Understanding Carbon Credits and Climate Change in the US

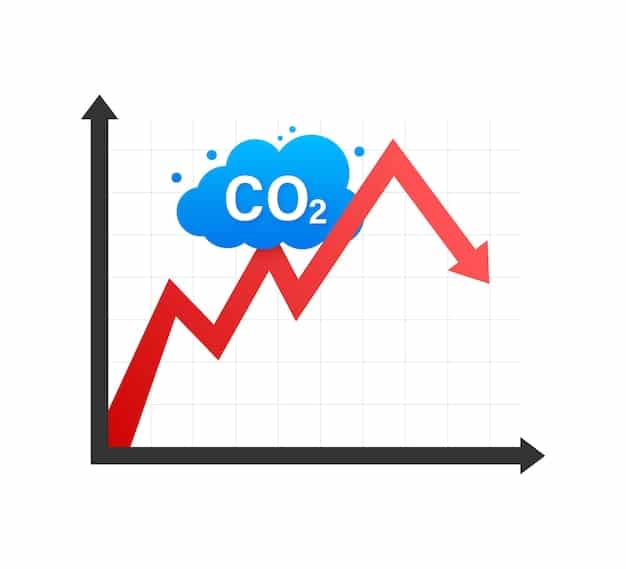

Climate change poses a significant threat to the US, with rising temperatures, extreme weather events, and sea-level rise impacting communities across the nation. Carbon credits have emerged as a market-based mechanism to mitigate greenhouse gas emissions, offering financial incentives for projects that reduce or remove carbon dioxide from the atmosphere. These credits can play a vital role in helping the US achieve its climate goals.

The Role of Carbon Credits

Carbon credits, also known as carbon offsets, represent a measurable reduction or removal of one metric ton of carbon dioxide equivalent (CO2e) from the atmosphere. These credits are generated by projects that actively work to reduce emissions or sequester carbon, such as renewable energy initiatives, reforestation efforts, and methane capture projects.

Challenges with Traditional Carbon Markets

While carbon credits offer a viable pathway to climate action, traditional carbon markets have faced challenges related to transparency, verification, and additionality. Opaque accounting practices and difficulties in accurately verifying the impact of carbon offset projects have led to concerns about the integrity and effectiveness of these markets.

To address these challenges, blockchain technology offers a transformative solution by providing a decentralized, transparent, and immutable platform for managing carbon credits.

In summary, carbon credits are a necessary tool in the fight against climate change, but they require significant improvements in transparency and accountability. Blockchain technology offers a unique opportunity to overcome these challenges and create a more trustworthy and effective carbon market.

How Blockchain Technology Enhances Carbon Credits

Blockchain technology, with its inherent transparency, security, and immutability, offers a powerful solution to the challenges facing traditional carbon markets. By leveraging blockchain, we can create a more trustworthy and efficient system for managing carbon credits, driving greater investment in climate action projects.

Transparency and Traceability

One of the key benefits of using blockchain for carbon credits is enhanced transparency. All transactions and data related to the creation, verification, and trading of carbon credits are recorded on an immutable ledger, accessible to all authorized participants. This transparency helps build trust and reduces the risk of fraud or manipulation.

Improved Verification and Additionality

Blockchain can also improve the verification process for carbon offset projects. By integrating smart contracts and IoT (Internet of Things) devices, data related to project performance can be automatically collected and verified. This data can then be used to ensure that carbon credits are only issued for projects that demonstrate genuine emissions reductions.

- Smart Contracts: Automate the issuance and trading of carbon credits based on pre-defined criteria.

- IoT Devices: Monitor and verify project performance in real-time, ensuring accurate data collection.

- Decentralized Verification: Engage multiple stakeholders in the verification process, enhancing credibility.

These features ensure that carbon credits represent real and additional emissions reductions, avoiding the issue of “phantom credits” that undermine the credibility of carbon markets.

In closing, blockchain technology’s capacity to enhance transparency, streamline verification, and improve additionality makes it an indispensable tool for the future of carbon credit markets. This technology can help drive greater confidence and participation in carbon offset projects, ultimately contributing to a more sustainable future.

The Potential Impact of Blockchain-Based Carbon Credits in the US by 2030

The integration of blockchain technology into carbon markets has the potential to revolutionize the way the US tackles climate change. By creating a more transparent, efficient, and trustworthy system, blockchain-based carbon credits can drive greater investment in climate action projects and accelerate the transition to a low-carbon economy by 2030.

Driving Investment in Climate Action

Blockchain-based carbon credits can attract new investors to the carbon market by providing greater transparency and confidence. Institutional investors, corporations, and individuals who were previously hesitant to invest in carbon offsets due to concerns about integrity may be more willing to participate in a blockchain-based system.

Supporting Sustainable Development Goals

Carbon offset projects often contribute to broader sustainable development goals, such as biodiversity conservation, poverty reduction, and community development. By ensuring that carbon credits are linked to verified and impactful projects, blockchain can help maximize the co-benefits of climate action.

The increased investment and sustainable outcomes driven by blockchain-based carbon credits can contribute significantly to the US meeting its climate goals by 2030.

In conclusion, the integration of blockchain technology into carbon markets has the potential to transform the way the US addresses climate change, driving investment, supporting sustainable development goals, and ensuring that carbon credits represent real and verifiable emissions reductions.

Challenges and Opportunities for Implementation

While the potential benefits of blockchain-based carbon credits are significant, there are also challenges to overcome in order to ensure successful implementation in the US. Addressing these challenges and capitalizing on the opportunities will be crucial for realizing the full potential of this innovative approach.

Regulatory and Legal Framework

One of the main hurdles is the lack of a clear regulatory and legal framework for blockchain-based carbon credits. Governments and regulatory bodies need to establish guidelines and standards for the issuance, trading, and verification of these credits to ensure consistency and legitimacy.

Scalability and Interoperability

Another challenge is the scalability and interoperability of blockchain platforms. Carbon markets involve a wide range of stakeholders and projects, and it is important that blockchain platforms can handle the volume of transactions and data generated by these activities. Interoperability between different blockchain systems is also essential for creating a seamless and efficient carbon market.

Despite these challenges, there are also significant opportunities for the successful implementation of blockchain-based carbon credits in the US. By addressing regulatory gaps, enhancing scalability, and promoting collaboration, we can unlock the full potential of this technology.

In essence, while challenges exist in implementing blockchain-based carbon credits, the opportunities for innovation and improvement in the carbon market are immense. By addressing regulatory gaps, enhancing scalability, and fostering collaboration, the US can lead the way in leveraging blockchain technology to combat climate change.

Case Studies: Blockchain Carbon Credit Projects in Action

Several pioneering projects are already demonstrating the potential of blockchain technology to transform carbon markets. These case studies provide valuable insights into the practical applications of blockchain-based carbon credits and highlight the benefits of this approach.

Veridium Labs

Veridium Labs is developing a blockchain-based platform for creating and trading carbon credits. The platform uses satellite imagery and machine learning to verify project performance and ensure the integrity of carbon credits. The platform aims to bring greater transparency and efficiency to the carbon market and attract new investors through verified, transparent offsets.

Open Forest Protocol

The Open Forest Protocol leverages blockchain to enhance the transparency and verifiability of forest carbon projects. By using a decentralized registry, the protocol ensures that all data related to carbon sequestration and forest management is immutably recorded and accessible to stakeholders. This promotes trust and encourages greater participation in forest carbon projects.

- Transparency: Clear and accessible project data promotes trust.

- Efficiency: Streamlined processes reduce administrative overhead.

- Scalability: Blockchain enables global participation in carbon markets.

These case studies demonstrate the diverse applications of blockchain-based carbon credits across different sectors and highlight the potential for this technology to drive meaningful climate action.

To summarize, initiatives like Veridium Labs and the Open Forest Protocol showcase the potential of blockchain-based carbon credits in action. By enhancing transparency, streamlining processes, and enabling global participation, these projects are driving innovation and progress in the fight against climate change.

Future Trends and Innovations in Blockchain Carbon Credits

As blockchain technology continues to evolve, we can expect to see further innovations and trends emerge in the realm of carbon credits. These advancements will likely focus on enhancing the efficiency, transparency, and impact of carbon markets.

Decentralized Autonomous Organizations (DAOs) for Carbon Offsetting

DAOs are emerging as a promising mechanism for decentralized governance of carbon offset projects. With DAOs, stakeholders can collectively make decisions about project development, verification, and distribution of carbon credits. This promotes inclusivity and ensures that projects are aligned with community needs.

Integration with Artificial Intelligence (AI)

The integration of AI with blockchain can further enhance the verification process for carbon offset projects. AI algorithms can analyze satellite imagery, sensor data, and other sources of information to detect deforestation, assess carbon sequestration rates, and monitor project performance.

These future trends and innovations hold the potential to transform carbon markets and accelerate the transition to a low-carbon economy.

To sum up, future trends such as DAOs and AI integration promise to further enhance efficiency, transparency, and impact in carbon markets. Embracing these innovations is essential for maximizing the potential of blockchain-based carbon credits and accelerating the transition to a sustainable, low-carbon economy.

| Key Point | Brief Description |

|---|---|

| ✅ Transparency | Blockchain ensures transparent tracking of carbon credits. |

| 🚀 Investment | Blockchain attracts new investors to climate action. |

| 🌱 Verification | Smart contracts automate project verification. |

| 🎯 US Goals | Aids the US in achieving its 2030 climate goals. |

Frequently Asked Questions

Blockchain-based carbon credits are digital assets representing verified carbon emission reductions, tracked and traded on a blockchain, ensuring transparency and immutability.

Blockchain enhances integrity by providing a transparent, tamper-proof record of carbon credit issuance and transactions, reducing fraud and double-counting.

Benefits include increased transparency, reduced transaction costs, improved verification processes, and enhanced investor confidence in carbon offset projects.

Challenges include regulatory uncertainty, scalability issues, and the need for interoperability between different blockchain-based carbon credit platforms across regions.

Blockchain can drive investment in climate action projects, ensure carbon credits represent real emissions reductions, and promote broader participation in carbon offsetting initiatives.

Conclusion

Blockchain-based carbon credits: how blockchain can help combat climate change in the US by 2030? The integration of blockchain technology into carbon markets offers a promising pathway to enhance the integrity, transparency, and efficiency of carbon offsetting initiatives. By addressing the challenges and capitalizing on the opportunities, the US can leverage blockchain to drive greater investment, accelerate the transition to a low-carbon economy, and achieve its ambitious climate goals by 2030.